As ever, here is what's ahead:

- Updates on prior pieces

- My most recent Rough Notes essay

- A few things worth reading

Updates & Erasures:

I previously wrote about the perils of building renovation as a Fed chair, especially given an administration bent on finding a reason to fire you "for cause." As anyone who has renovated anything larger than a dog house knows, no one thinks what you spent on renovation makes sense, not even you. Most spouses wish they could fire someone for cause over most renovations.

In that light, this WSJ explainer of the ongoing Federal Reserve renovations is useful reading as various administration officials feign dismay at someone renovating a building that hasn't been renovated in ... ever. Shocked, I am shocked to find renovations going on in here.

On Tuesday, T***p said he was surprised to learn about the costly building renovations, given his view that Powell is a boring and unintelligent person. “I think he’s a total stiff, but the one thing I didn’t see him [as] is a guy that needed a palace to live in,” he told reporters.

Say what you will about Powell's monetary policy, either that wallpaper doesn't go¹, or Powell does, apparently.

¹ Writer Oscar Wilde's final words may or may not have been: "This wallpaper and I are fighting a duel to the death. Either it goes or I do.”.

Rough Notes:

Honey, AI Capex Ate the Economy

How extreme is AI datacenter spending? It is to the point that even Chinese President Xi Jinping is warning about it. With more than 250 datacenters under construction in his country, this week he cautioned against the spending rush, threatening to intervene:

“When it comes to projects, there are a few things — artificial intelligence, computing power and new energy vehicles. Do all provinces in the country have to develop industries in these directions?"

The U.S., however, leads the capex spending way. One analyst recently speculated (via Ed Conard) that, based on Nvidia's latest datacenter sales figures, AI capex may be ~2% of US GDP in 2025, given a standard multiplier. This would imply an AI contribution to GDP growth of 0.7% in 2025.

I wrote previously about some of the unintended consequences, in particular the emergence of off-balance sheet funding vehicles. Let's dive into its size and consequences again, however, with three thoughts in mind:

- The above impact estimates may be a lower bound.

- The redirected capital spending is coming from somewhere.

- All this spending helps explain a mystery.

1. A Lower Bound?

Here are some basic numbers to get things started:

- US 2025 GDP: $25 trillion (Source: Consensus forecasts and extrapolations from BEA data)

- Nvidia sales to datacenters (Q1 FY2026): $39.1B (Annualized: $156.4B)

- % of Nvidia datacenter sales that is AI related: ~99% (Primarily H100/GH200 sales to hyperscalers and enterprises)

- Nvidia share of datacenter capex: 25-35%

- Economic multiplier: 1.5x-2.0x

- Implied total datacenter capex: ~$520B (156.4b/0.3)

So, to get the total GDP impact, including multipliers, do the simple math:

These are very large numbers given that before 2022 AI capex was likely less than 0.1% of GDP. It has, in three years, grown by at least 10x from there, and perhaps more than that.

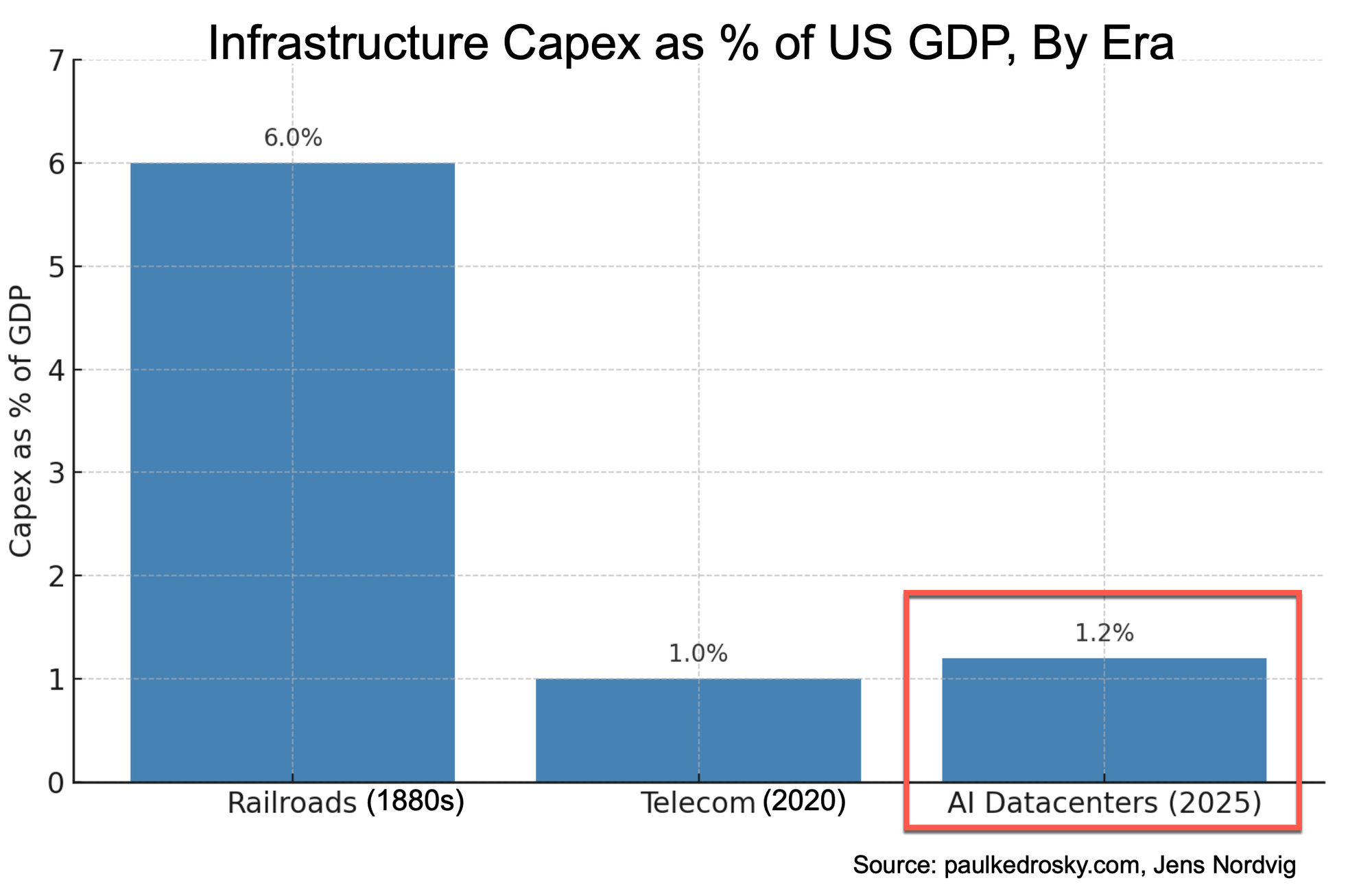

Compare this to prior capex frenzies, like railroads or telecom. Peak railroad spending came in 19th century, and peak telecom spending was around the 5G/fiber frenzy. It's not clear whether we're at peak yet or not, but ... we're up there. Capital expenditures on AI data centers is likely around 20% of the peak spending on railroads, as a percentage of GDP, and it is still rising quickly. And we've already passed the decades ago peak in telecom spending during the dot-com bubble

Again, these are raw capex numbers, unadjusted for multiplier effects. In other words, it's just the purchasing and building of that stuff, not whether you, as a recipient of some of this spending, renovated your kitchen. To calculate the total economic effect you would apply the economic multiplier I laid out above, and the numbers become even larger. I return to this in the final part of this essay.

2. Where is the Money Coming From?

Private capital expenditures don't, for the most part, come from nowhere. While governments can print money to spend, companies generally can't. Where is all this capital coming from?

For the most part, six sources:

- Internal Cash Flows (Primary for Microsoft, Google, Amazon, Meta, etc. )

- Debt Issuance (Rising role)

- Equity & Follow-on Offerings

- Venture Capital / Private Equity (CoreWeave, Lambda, etc.)

- SPVs, Leasing, and Asset-Backed Vehicles (like Meta's recent)

- Cloud Consumption Commitments (mostly hyperscalers)

But by spending GDP-moving amounts of money on GPUs and such, it is not, by definition, being spent on something else.

Some examples:

- Non- life science venture capitalists are mostly only doing AI right now. Have something else needing funding? Good luck with that.

- Cloud compute companies are diverting spending from cloud offering to GPU-centric data centers. Amazon's recent cloud layoff announcement is being driven by this; Microsoft's recent layoffs are better understood in this light than as being driven by AI taking jobs, as some argued.

- Price-earnings multiples on public AI "plays" are soaring, reflection disproportionate investor allocation to these companies, and less to others, who can no longer obtain capital as cheaply.

- Manufacturing and other infrastructure are, to a degree, starved for capital as it increasingly gets re-routed to datacenters.

All of this has consequences, or will. The telecom capex bubble lead to a sharp decline in "other" infrastructure spending, one that is still playing out. The datacenter spending frenzy will almost certainly do the same, starving other infrastructure for money.

3. Solving an Economic Mystery

One of the abiding mysteries of the current political era is why the economy is, for the most part, not as worried as one might expect about tariffs, political uncertainty, capricious office-renovation-driven-Fed-chair rumored removals.

We now have a possible answer. In a sense, there is a massive private sector stimulus program underway in the U.S.. There is an AI datacenter spending program, one that is reallocating gobs of spending, as well as injecting even more. It is already larger than peak telecom spending (as a percentage of GDP) during the dot-com era, and within shouting distance of peak 19th century railroad infrastructure spending.

So, how big was this "stimulus" in the first quarter? Back of ... something or another, based on the above figures:

- Without AI datacenter investment, Q1 GDP contraction could have been closer to –2.1%

- AI capex was likely the early-2025 difference between a mild contraction and a deep one, helping mask underlying economic weakness.

Conclusion

We are in a historically anomalous moment. Regardless of what one thinks about the merits of AI or explosive datacenter expansion, the scale and pace of capital deployment into a rapidly depreciating technology is remarkable. These are not railroads—we aren’t building century-long infrastructure. AI datacenters are short-lived, asset-intensive facilities riding declining-cost technology curves, requiring frequent hardware replacement to preserve margins.

And this surge has unintended consequences. Capital is being aggressively reallocated—from venture funding to internal budgets—at the expense of other sectors. Entire categories are being starved of investment, and large-scale layoffs are already happening. The irony: AI is driving mass job losses well before it has been widely deployed.

Rougher Notes:

University of California ditches hedge funds with scathing rebuke ... Jane Street’s trading scrutiny in India … Mosaic looted by Nazi officer returned to Pompeii … Common sweetener erythritol may impact brain cells, boost stroke risk … Culture critics as we know them might be an endangered species … Did increasing brain size place early humans at risk of extinction? … World economy’s resilience being worn away bit by bit … KKR mid-year outlook: make your own luck … Robot metabolism: machines that grow by consuming others … American's whey protein obsession is reshaping the dairy industry … Ex-Waymo engineers are trying to roboticize construction … China drugmakers are catching up to US Big Pharma